Inside Nigeria

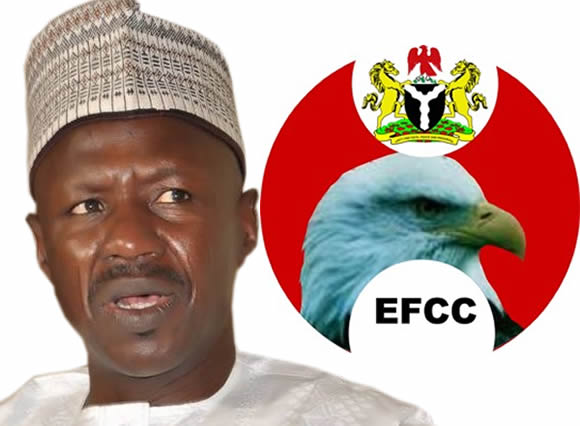

EFCC, Supposed Independent Agency, Blasts HSBC For Predicting Buhari’s Failure In 2019

Just like the Presidency, the Economic and Financial Crimes Commission (EFCC), has also slammed UK Bank, HSBC for saying that the second term of President Muhammadu Buhari would stunt the economy.

While the EFCC is expected to act independently without political interference, the agency stated that the UK bank, HSBC, which is Europe’s largest by total asset, was synonymous with money laundering.

The tweet on the commission’s official handle reads;

‘The Story of HSBC’, the anti-graft agency said over $100m was laundered by the bank on behalf of Abacha.

“The HSBC bank is one of the largest banking and financial services organisations in the world. The HSBC’s international network comprises around 7, 500 offices in over 80 countries and territories in Europe, the Asia-Pacific region, the Americas, the Middle East and Africa.

“Since inception, HSBC is synonymous with money laundering and has paid billions of US dollars in fines across the world.

“In Nigeria the bank laundered more than $100m for the late dictator, General Sani Abacha, in Jersey, Paris, London and Geneva. The bank is also involved with laundering proceeds of corruption for over 50 Nigerians including a serving Nigerian senator.

“Part of Abacha’s assets yet to be recovered are: $12m in HSBC Fund Admin Ltd with account number S-104460 in Jersey; $20m in HSBC Life (Europe) with account number 37060762 in the UK and $1.6m in HSBC Bank Plc with account number 38175076 in the UK.

“We shall not rest until every penny belonging to the Federal Republic of Nigeria is repatriated to Nigeria as to improve the lives of the people.”

HSBC had in a Global Research unit, title ‘Nigeria, papering over the cracks’ stated that President Buhari’s approval ratings sit near all-time lows, a development which largely reflects the impact of Nigeria’s painful recession in 2016-17 and the sustained economic hardship that has accompanied his presidency, including rapidly rising joblessness, and poverty.

According to the bank, Mr Buhari “raises the risk of limited economic progress and further fiscal deterioration, prolonging the stagnation of his first term, particularly if there is no move towards completing reform of the exchange rate system or fiscal adjustments that diversify government revenues away from oil.”