Inside Nigeria

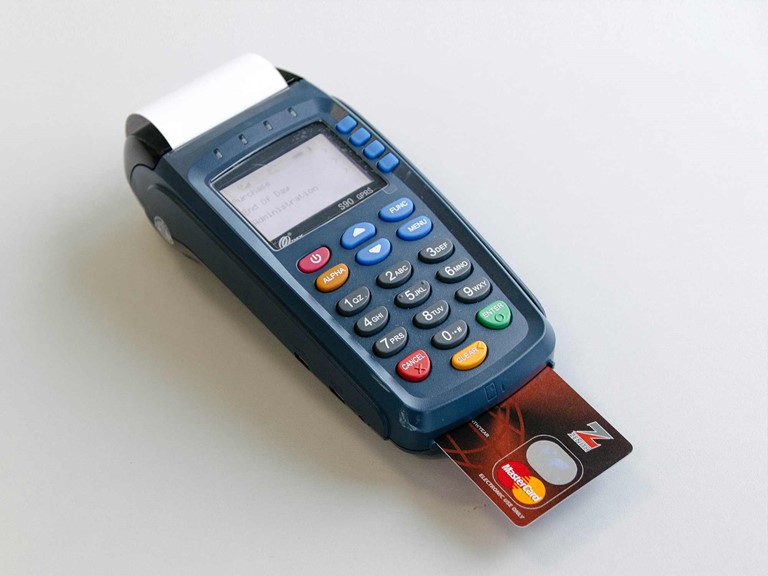

N50 POS Charge Begins

The Central Bank of Nigeria (CBN) and the Nigeria Interbank Settlement System (NIBSS) are working for the application of remittance processes to ensure the seamless collection of stamp duty charges for PoS.

Many filling stations and supermarkets are already adding the new fee to the customer’s purchases.

To avoid dispute with its customers, filling stations have pasted notices on their pumps.

In a notice to its customers, a filling station official said: “N50 Stamp Duty Charge on PoS Transactions. Following the CBN directive of September 17, 2019 to charge applicable taxes and duties on individual electronic transactions, all Hayden Retail Stations shall henceforth charge N50 extra on all PoS transactions from N1, 000.”

Before now, the fee paid by merchants on the aggregate PoS transactions carried out on a particular period, which was never passed to customers.

The extra charge on customer’s transaction followed a CBN’s directive to banks to charge N50 Stamp Duty on individual transactions, rather than merchants’ accounts.

The directive on the Unbundling of Merchant Settlement Amounts was contained in the CBN circular to banks, processors and switches, titled: “Review of Process for Merchants Collections on Electronic Transactions”.

The policy stipulates Stamp Duties Payment on individual transactions that occur on PoS, rather than previous plans where charges occurred on aggregate transactions.

The circular signed by CBN Director, Payments System Management Department, Sam Okojere, authorised banks to unbundle merchant settlement amounts and charge applicable taxes and duties on individual transactions as stipulated by regulators.

Merchant Service Charge was also reviewed downward from 0.75 per cent (capped at N1, 200) to 0.50 per cent (capped at N1, 000).

In a NIBSS report titled: “Returns on Stamp Duty Collection for Merchant Transactions”, the payment agency said the new stamp duty payment plan is in line with the provision of the Stamp Duties Act and Federal Government Financial Regulation 2009.

The policy, it added, was aimed at ensuring strict adherence to the CBN guideline communication on the subject, collection and Remittance of Statutory Charges on receipts to Nigeria postal Service under the Stamp Duties Act dated 15th January 2016.

The procedural processing guide for stamp duty Charges for PoS, web merchant and all deposit money banks (DMBs) should download daily PoS/Web settlement report from their respective processors settlement file transfer portal.

Also, the PoS and web settlement processing officer shall ensure that stamp duties are correctly processed daily by downloading daily PoS/web transactions valued at N1, 000 and above, noting the count of these transactions; multiply the count of these transactions by N50 and pass the corresponding debit/charge to the respective merchant accounts.

The apex bank guideline said: “The debit should be passed to the merchant accounts account at the point of PoS/ Web merchant Credit/Settlement to mitigate against the inability of the Deposit Money Banks (DMBs) to successfully secure these daily stamp duties charges and remit as expected.

“These charges are expected to be deposited into the already opened stamp duty collections account at the various DMBs and should form part of the weekly Stamp Duty rendition by the DMBs to NIBSS.”

The NIBSS data showed the total volumes of PoS transactions for 2017 stood at 146.3 million which was worth N1.4 trillion; 285.9 million transactions in 2018 worth N2.3 trillion and 187.7 million for six months- January to June 2019 worth N1.4 trillion.